Market Making Bots vs. Traditional Trading — Which is Best for 2025?

Bitcoin is going to hit $100,000 soon! The market trends were clearly showing where the №1 cryptocurrency is headed. After Trump’s victory in the U.S. presidential election, the market has been moving like a FORD Mustang with a NOS. While there seems no stopping even for a pitstop (some downtrend), traders are confused about whether it will continuously go up, or the market will break soon. So how can we make profits even in this unpredictable market?

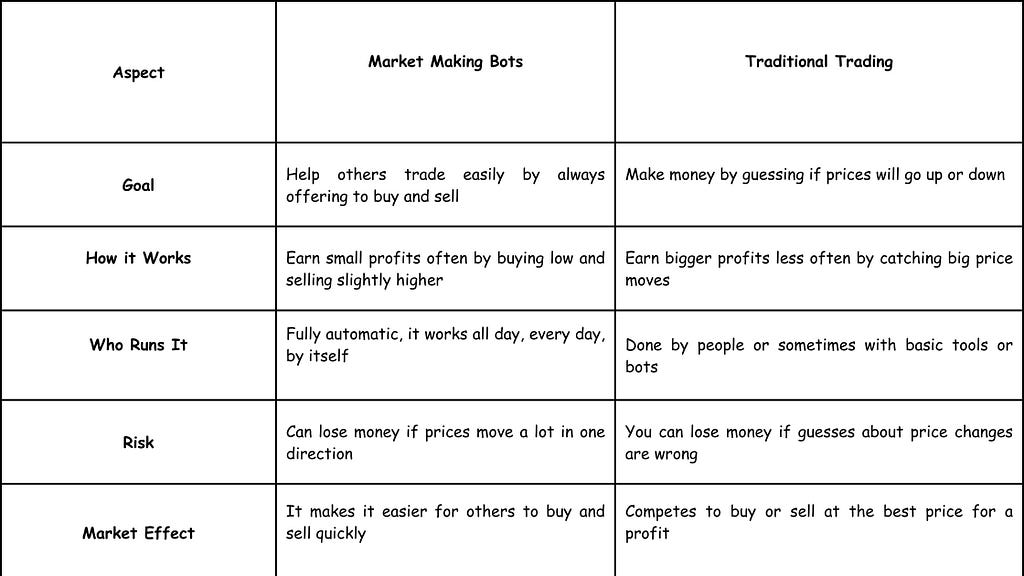

Traditional traders often face losses due to the wrong strategies for the current market. While, some made profits with the help of a crypto trading bot, especially from Crypto Market Making Bot Development. There are a lot of mixed predictions for the upcoming 2025 crypto market, so trading will be difficult. In this blog, we will differentiate between Market Making Bots and Traditional Trading and which is best for 2025.

Market-Making Bots

A crypto market-making bot is like your super-smart, always-awake shopkeeper in the crypto industry. Its job is to make trading smoother by constantly offering to buy and sell tokens on your behalf. Think of it as setting up a mini store in the middle of a busy market.

The bot places buy and sell orders around the current price of a cryptocurrency, like Bitcoin. For example, if Bitcoin is $30,000, the bot might offer to buy at $29,995 and sell at $30,005. It earns a tiny profit from the difference in these prices called the spread. Sounds small, right? But when done thousands of times a day, it adds up.

Assume you’re running a lemonade stand. You buy lemons for $1 each and sell them for $1.10. That $0.10 per lemon is your profit. Now imagine a bot running the stand 24/7, buying and selling at lightning speed. That’s what market-making is.

Market Making Bots vs. Traditional Trading

Which is Better?

Traditional crypto trading is like being a hunter, you’re out there watching charts, waiting for the right moment to pounce, and hoping your instincts are on point. It’s interesting but also exhausting. You’re glued to the screen, reacting to the market’s every move, and emotions often take over. Not to mention, you might miss chances when you’re sleeping or distracted.

Now, market-making bots? They’re like your super-smart assistants who never sleep, never stress, and never miss a beat. They don’t just react to the market, they actively participate, constantly buying and selling to create liquidity.

While enjoying your coffee or watching your favorite series, these bots are crunching numbers and executing trades faster than any human could. Plus, they remove emotions from the equation — no fear, no greed — just cold, calculated decisions. With these, there are a lot of things that make Market Making Bot Development a better choice for 2025.

Final Words

In conclusion, which is better? Honestly, it depends on your style. Are you the type to trust a bot to grind profits 24/7 while you Netflix and chill? Or do you prefer poring over charts at 2 a.m., with a coffee and sheer willpower? As Benjamin Franklin might’ve said (if he dabbled in trading): “Invest in tools that work while you sleep but never stop sharpening your skills.” Play your cards right, and 2025 could be your breakout year, no matter which strategy you choose. Additionally, flash loan arbitrage bots which will be developed by Crypto flash loan arbitrage bot development company are evolving now.

Market Making Bots vs. Traditional Trading — Which is Best for 2025? was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.