As February comes to an end, financial markets have experienced sharp movements across major asset classes. Let’s break down the highlights:

📉 Stock Markets:

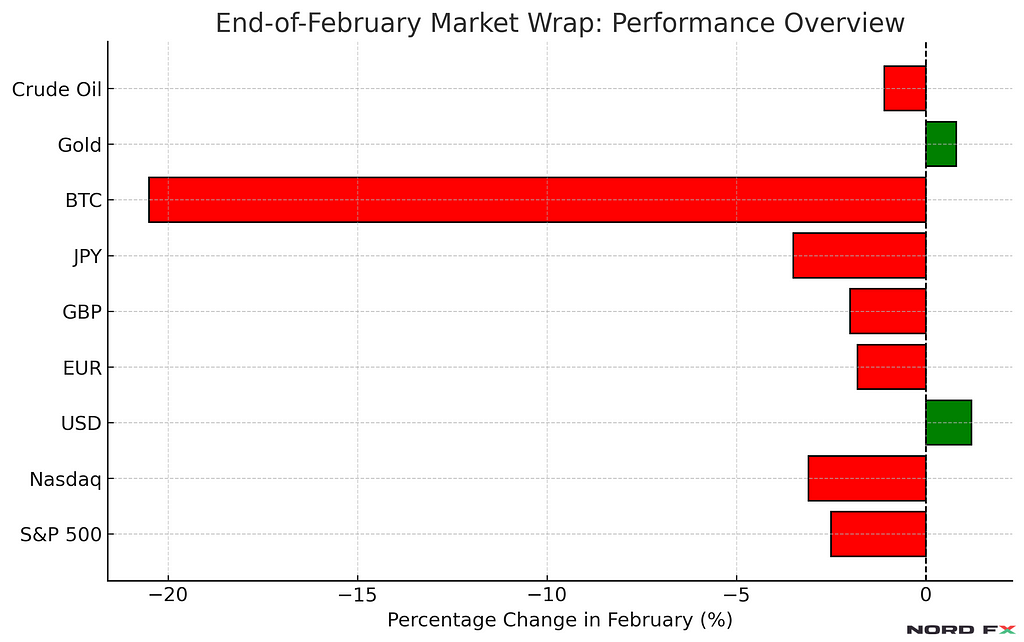

Global equity markets faced turbulence, with the S&P 500 and Nasdaq pulling back after their early-year rally. Concerns over inflation data 📈 and the Federal Reserve’s next moves kept investors cautious, leading to a choppy trading environment. Tech stocks, in particular, saw increased volatility as profit-taking weighed on recent gains.

💰 Forex & Central Banks:

The US dollar (USD) showed resilience against major peers, driven by strong economic data and speculation that the Fed might delay rate cuts. Meanwhile, the euro (EUR) and British pound (GBP) struggled as economic growth in Europe remained sluggish. The Japanese yen (JPY) 📉 weakened further, as the Bank of Japan signaled a cautious approach to tightening monetary policy.

📌 Crypto Market Selloff:

After reaching new highs in January, bitcoin (BTC) and other cryptocurrencies faced a sharp correction, with BTC dropping over 20% from its peak. Liquidations of leveraged positions and regulatory concerns ⚖️ contributed to the sell-off. However, long-term investors remain optimistic, eyeing potential bullish catalysts in March.

🛢️ Commodities & Gold:

Crude oil prices saw fluctuations, impacted by geopolitical risks and OPEC’s supply strategy. Meanwhile, gold (XAU/USD) maintained its strength above key support levels, as investors sought safe-haven assets amid market uncertainty.

🎯 What’s Next?

As we enter March, all eyes will be on the next economic reports, interest rate decisions, and geopolitical developments. Will the volatility continue, or will markets find stability?

👉 Reflect on February’s trading insights and position yourself for success in March with NordFX. Get Started 🚀

📊 End-of-February Market Wrap: Key Insights for Traders was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.