The Illusion of Fiscal Responsibility: Why Government Spending Cuts in a Debt-Based System Punish Americans

In a debt-based monetary system like the United States, government spending cuts are often framed as a necessary measure to promote “efficiency” and “fiscal responsibility.” However, these cuts do not actually reduce debt in any meaningful way. Instead, they serve as a mechanism to restrict the flow of money to the public while the government continues to borrow and spend on priorities that primarily benefit corporate interests and financial institutions.

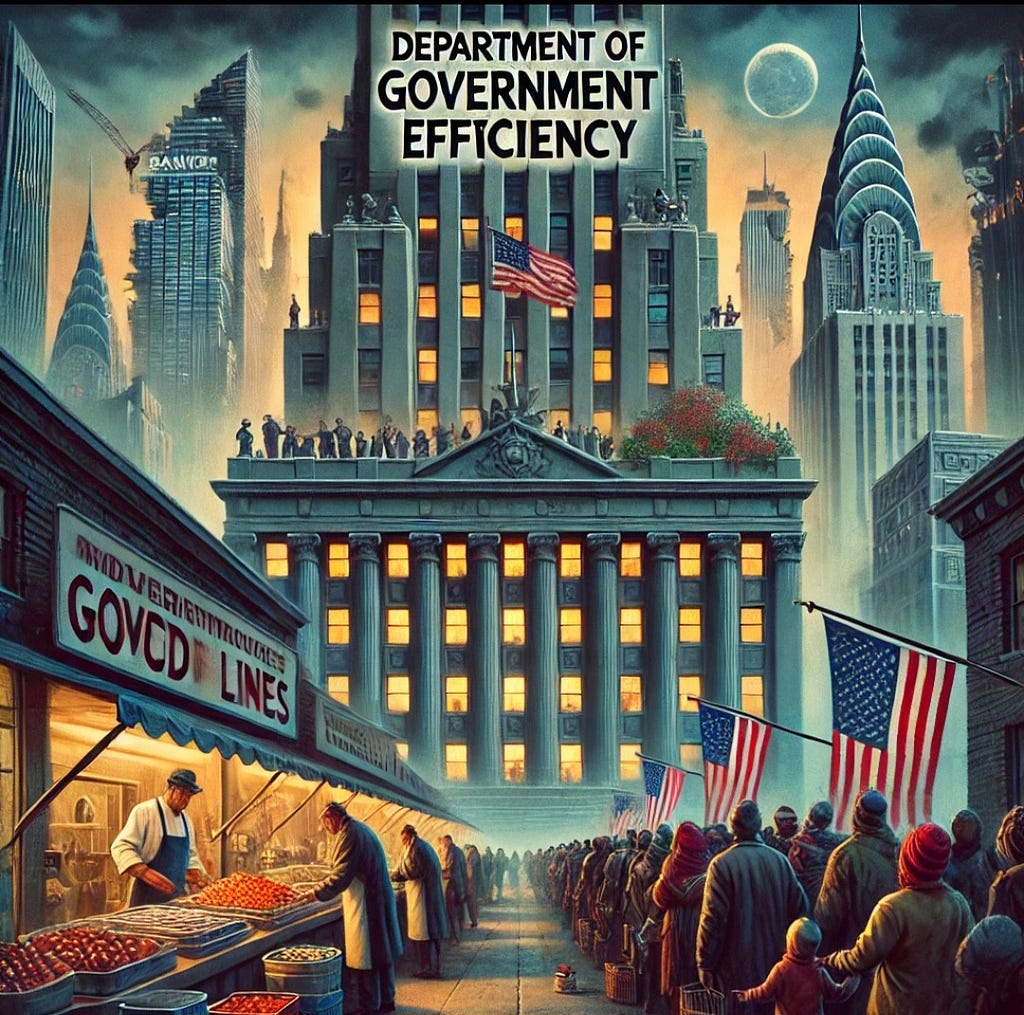

The recent push for spending cuts—whether spearheaded by a hypothetical **Department of Government Efficiency** or real-world austerity measures—does not address the root issue: the U.S. operates on a **debt-based currency system** that requires continuous expansion to sustain itself. In this system, government debt is not a liability in the traditional sense but rather a fundamental feature that allows the economy to function. Cutting spending under these conditions does nothing but shift the burden of debt expansion onto private citizens while maintaining the same underlying financial structure.

Debt-Based Currency: The Engine of the U.S. Economy

To understand why spending cuts make little sense in this system, it’s crucial to recognize how the U.S. dollar works. Unlike commodity-backed money (such as the gold standard), modern fiat currency is **created through debt issuance**. Every dollar in circulation was initially created as debt—either by the government (through Treasury bonds) or by banks (through loans).

Since money itself is **borrowed into existence**, government debt is never truly meant to be “paid off.” Instead, it is perpetually rolled over through new borrowing, ensuring a constant expansion of the money supply. Under these conditions:

1. **Government debt is not like household debt** – Unlike an individual who must balance their budget, the government can always issue more debt, which the Federal Reserve can monetize if necessary.

2. **Cutting spending does not reduce total debt** – It simply shifts financial strain onto private individuals and businesses, who must take on more debt to sustain economic activity.

3. **The system requires perpetual expansion** – If debt issuance stops, the economy contracts, leading to recessions or depressions.

The Real Purpose of Spending Cuts: Restricting the Flow of Money to the Public

Given that the government can always issue more debt and expand the money supply, the question arises: **why push for spending cuts at all?** The answer lies in **who benefits from debt expansion and who suffers from spending reductions**.

1. **Public vs. Private Debt Burden**

– When the government spends, money flows into the hands of ordinary citizens through social programs, infrastructure projects, and public services.

– When spending is cut, the private sector must take on more debt to sustain itself—whether through credit cards, student loans, mortgages, or business loans.

– This benefits financial institutions, which profit from issuing debt at interest, while making life harder for the average worker.

2. **Inflation and Monetary Control**

– Politicians often claim that cutting spending helps “control inflation,” but this is misleading. Inflation is primarily driven by corporate pricing power, supply chain disruptions, and Federal Reserve monetary policy—not public spending.

– Even when government spending is cut, the Federal Reserve can still expand the money supply through **quantitative easing, corporate bailouts, and financial market interventions**.

– The real result of spending cuts is a **redistribution of financial strain**: fewer public benefits for ordinary people, but continued financial support for banks and corporations.

3. **Austerity as a Tool for Wealth Redistribution**

– Spending cuts are often framed as necessary sacrifices for the good of the country. In reality, they serve as **justifications for weakening public programs while maintaining corporate welfare**.

– Defense budgets, corporate subsidies, and tax cuts for the wealthy rarely face the same scrutiny as social programs. This selective application of austerity reveals its true purpose: **concentrating wealth and power**.

The Debt Ceiling Farce: A Political Tool, Not a Financial Limit

One of the most blatant examples of this manufactured financial crisis is the **debt ceiling debate**. The U.S. does not have a true debt limit because the government can always borrow more money. The only reason for these recurring political fights is to justify cuts to public spending while allowing spending in other areas—such as military budgets or tax breaks for the wealthy—to continue unhindered.

Since the government **cannot actually run out of money**, the debt ceiling is simply a **political weapon used to force austerity measures** that disproportionately harm working-class Americans. If the debt ceiling were a real constraint, it would apply universally—but it does not.

Conclusion: The True Purpose of “Government Efficiency” in a Debt-Based System

A **Department of Government Efficiency** making spending cuts would not be about making the system more stable or financially responsible. It would be about **justifying austerity while keeping the debt machine running in a way that benefits corporations and the financial elite**.

In a system where money itself is created as debt, cutting spending on public programs does not “save” money—it simply redirects the flow of new debt into the hands of private banks, lenders, and the ultra-wealthy. The result is a society where the rich get richer, the poor struggle under increasing financial burdens, and the public is misled into believing that fiscal responsibility means sacrificing their own well-being.

Ultimately, the push for government spending cuts in a debt-based system is not about fixing the economy—it’s about **punishing the American people while protecting the interests of those who profit from perpetual debt expansion**.

The Illusion of Fiscal Responsibility: Why Government Spending Cuts in a Debt-Based System Punish… was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.