Introduction

Maestro Bot, a Telegram-based trading tool, is a favorite among cryptocurrency enthusiasts, especially for DeFi and token sniping across blockchains like Ethereum (ETH), Binance Smart Chain (BSC), Solana, and Arbitrum. With features like auto-buy, anti-rug protection, and copy trading, it’s a powerful ally — provided you configure it right. Drawing from the wisdom of professional traders, tailored to different trading approaches.

Learn More: Best Solana Wallets

Learn More: Best Solana Copy Trade Bots

Learn More: Best Solana Trading Bots

Learn More: Solana Sniper Bots

Learn More: Best Solana Dexs

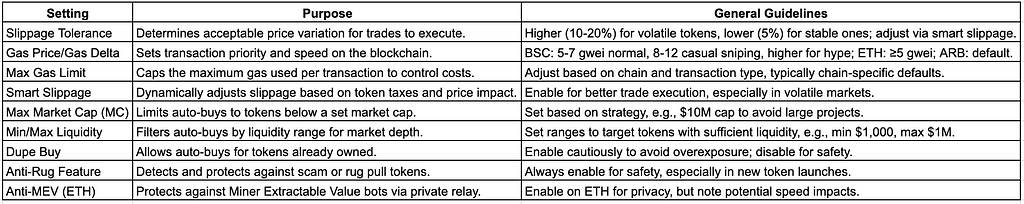

Key Settings and Recommendations

Professional traders emphasize the following configurations to maximize Maestro Bot’s potential:

Slippage Tolerance

Slippage tolerance governs how much price movement you’ll accept for a trade to go through. For volatile tokens, such as fresh launches, pros recommend 10–20% to ensure execution in fast markets. For stable tokens, they suggest dialing it down to 5% to keep costs in check. Many also advocate for smart slippage, a feature that adjusts dynamically to token taxes, boosting efficiency.

Gas Price/Gas Delta

Gas settings dictate transaction speed and expense. On BSC, traders advise 5–7 gwei for routine trades, 8–12 gwei for casual sniping, and higher for high-demand launches. On ETH, a baseline of 5 gwei is standard, scaled up during network spikes. For Arbitrum, sticking to defaults often suffices. These ranges help balance speed and cost effectively.

Max Gas Limit

This caps gas expenditure per transaction. Pros recommend setting it to chain-specific defaults or slightly higher, ensuring trades don’t fail while keeping fees reasonable. Precision here depends on the blockchain and trade urgency.

Safety Features

Anti-rug protection is a must, according to seasoned traders, as it guards against scams — a persistent threat in DeFi. For ETH users, enabling anti-MEV (Miner Extractable Value) protection via private relays adds a privacy layer, though it might trade off some speed.

Auto-Buy Filters

To target ideal tokens, set a max market cap (e.g., $10M) and liquidity range (e.g., min $1,000, max $1M). Pros suggest enabling “dupe buy” only with caution, as it permits repeat purchases but risks overexposure if unchecked.

Tailoring to Your Trading Style

Your approach shapes the settings:

- Aggressive Snipers: Pros chasing presales or token launches boost gas to 12+ gwei on BSC and 5+ on ETH, with slippage at 10–20%. They often use God Mode for block-zero entries and leverage copy trading to mimic top performers.

- Conservative Traders: For those prioritizing safety, lower gas (5–7 gwei on BSC) and slippage (5%) minimize costs. They rely on manual oversight and lean heavily on anti-rug features for protection.

Insights from Professional Traders

Veteran traders stress adaptability. One common tip is to start with conservative settings — low gas and slippage — then adjust upward as market conditions demand. They also recommend monitoring blockchain activity (e.g., via Etherscan for ETH) to fine-tune gas in real time. Safety features like anti-rug are non-negotiable, especially in the scam-prone world of new tokens.

Practical Tips

- Test Incrementally: Begin with modest settings and refine them based on trade outcomes. High-volatility scenarios may call for bolder gas and slippage adjustments.

- Know Your Chain: Gas needs vary — Solana’s fluidity, for instance, might require higher deltas than BSC’s predictability.

- Stay Informed: Pros keep tabs on Maestro Bot updates through official channels, ensuring settings align with new features.

Conclusion

The best Maestro Bot settings hinge on your goals, but professional traders offer a clear starting point: 10–20% slippage for volatile tokens, gas at 5 gwei or higher (tuned per chain), and anti-rug always on. Whether you’re sniping aggressively or trading conservatively, success lies in customizing these to your strategy and the market’s mood. With these insights, Maestro Bot becomes a precision tool in the hands of any trader.

Exploring the Best Alternatives to Maestro Bot

In the fast-paced world of cryptocurrency trading, finding the right tools can make all the difference. Traders often seek alternatives to popular bots like Maestro Bot to enhance their strategies and performance. Based on insights gathered from professional traders, this article dives into some of the top alternatives — GMGN.io, BullX, Nova, Photon, and others — each offering unique features tailored to different trading needs. Below, we explore these options in detail to help you decide which might suit your trading style best.

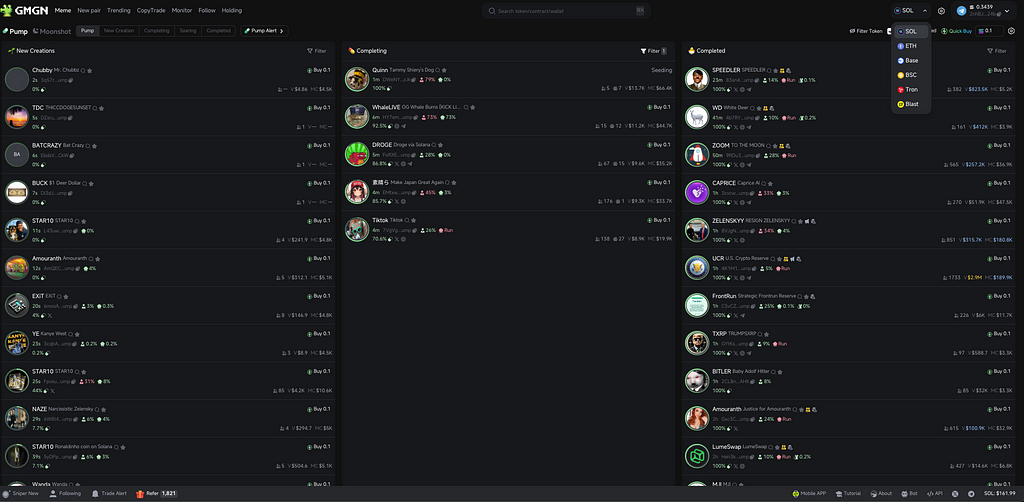

1. GMGN.ai

https://t.me/gmgnaibot?start=i_NkduWlgN

GMGN.ai stands out as a versatile platform, particularly favored for its focus on meme coin trading and advanced analytics.

It combines a Telegram bot with a robust web interface, making it accessible for traders on the go. Known for its AI-driven strategies, GMGN.ai excels in token sniping and tracking smart money movements, giving users an edge in spotting high-potential opportunities early.

The bot’s real-time liquidity monitoring helps minimize slippage, while its automation features allow traders to set parameters and let the system execute trades seamlessly.

This makes it a strong choice for those who prioritize adaptability and cutting-edge market insights.

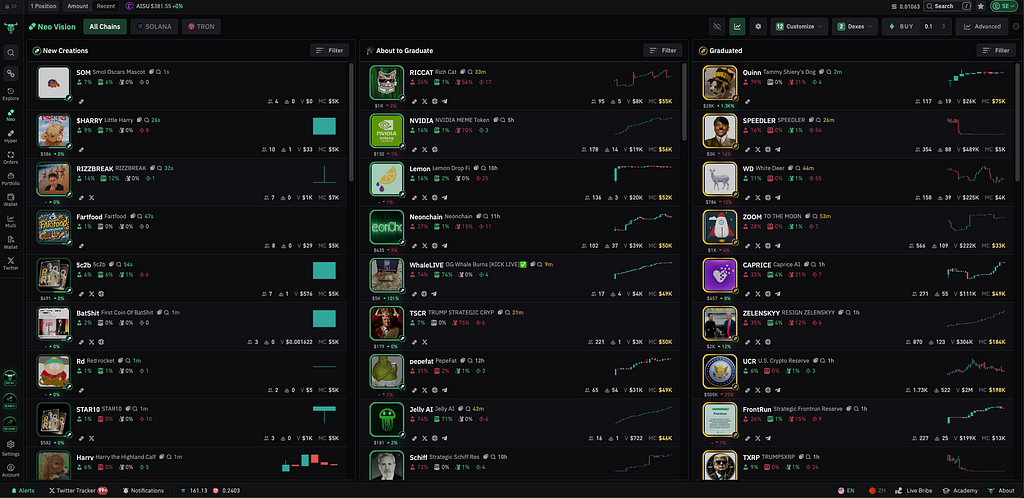

2. BullX

https://neo.bullx.io/p/easyconnect

BullX is widely regarded as a powerhouse among trading bots, especially its Neo version, which has earned praise for its speed and efficiency. Operating across multiple blockchains — including Solana, Ethereum, and Binance Smart Chain — it offers flexibility for traders diversifying their portfolios. BullX’s Pump Vision Terminal provides real-time data on trending tokens, helping users stay ahead of market shifts.

Its straightforward 1% fee structure for both buying and selling adds predictability to trading costs, while the invite-only access ensures a premium, optimized experience. Traders who value multi-chain support and a sleek, customizable interface often turn to BullX as a reliable alternative.

3. Nova

https://t.me/TradeonNovaBot?start=r-TRADENOW

Nova is a Telegram-based bot built to give traders a competitive advantage, particularly on the Solana network. Designed with speed in mind, it integrates seamlessly with platforms like BullX and Photon, offering a streamlined interface that simplifies complex trades. Nova shines in sniping and quick execution, making it ideal for fast-paced markets where timing is critical. Features like multi-wallet management and automated trading rules allow users to diversify strategies without constant oversight. For traders seeking efficiency and rapid transaction capabilities, Nova is a compelling option that complements existing tools.

4. Photon

https://photon-sol.tinyastro.io/@goldone

Photon takes a different approach by focusing solely on the Solana blockchain, delivering a web-based platform known for its lightning-fast execution. Unlike Telegram bots, Photon eliminates lag by connecting directly to Solana’s high-speed network, integrating with DEXs like Raydium and Orca. Its “New Pairs” view is a standout feature, enabling traders to spot and act on newly launched tokens instantly. While it lacks multi-chain support, Photon’s simplicity and stability make it a top pick for beginners and Solana-focused traders who prioritize speed over advanced customization.

5. Trojan

https://t.me/solana_trojanbot?start=r-seomanager

Trojan is a Telegram-based bot that has built a reputation for its automation and rapid trade execution on Solana. It integrates with major DEXs like Jupiter and Orca, ensuring liquidity and smooth transactions. Traders appreciate its customizable fee options — ranging from standard to turbo settings — which allow for tailored performance based on urgency. While it doesn’t offer the multi-chain versatility of some competitors, Trojan’s focus on speed and ease of use makes it a solid choice for those targeting Solana’s meme coin and DeFi markets.

Additional Alternatives

Beyond these top contenders, other bots like BonkBot, SolTradingBot, and Shuriken also deserve mention. BonkBot caters to memecoin enthusiasts with its simple setup and Solana-specific tools, ideal for traders focused on high-volatility assets like BONK. SolTradingBot offers portfolio management features alongside trading, appealing to users who want a more holistic approach. Shuriken, meanwhile, brings AI-enhanced sniping and a growing feature set, positioning it as an emerging player for tech-savvy traders. Each of these options caters to niche preferences, rounding out the landscape of Maestro Bot alternatives.

Final Thoughts

Choosing the best alternative to Maestro Bot depends on your trading goals. GMGN.ai leads with its AI-driven insights and meme coin prowess, while BullX offers unmatched multi-chain flexibility. Nova delivers speed and efficiency for Solana traders, and Photon excels in simplicity and execution speed. Trojan and the additional bots provide further variety, ensuring there’s a tool for every strategy. Professional traders highlight these platforms for their unique strengths, so consider your priorities — whether speed, analytics, or accessibility — to find the perfect fit for your crypto journey.

Learn More

- BULLX ACCES CODE

- Best Solana Copy Trade Bots

- Best Soalan Sniper Bots

- Best ETH Bots

- Best SOLANA Dexs

- Best Solana Trading Bots

- Best Solana Wallets

- Best BSC Wallets

- Best Ton Wallets

- Nova access Code

- Best DEXS for Futures Trading

- Best BSC Trading Bots

- Top BSC Dexs

- Best Base Network Trading Bots

- Bullx Exchange

- BULLX CODE

- Bullx Neo

The Best Settings for Maestro Bot + Top Alternatives was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.