Decentralized Exchanges, or DEXs, are cryptocurrency trading platforms that operate on decentralized networks, typically blockchains, without a central authority. This structure ensures users retain control over their funds, with transactions executed via smart contracts. DEXs enhance security by eliminating a single point of failure, offer transparency through on-chain data, and provide censorship resistance, aligning with the decentralized ethos of cryptocurrencies.

Learn More Best SOLANA Dexs

Learn More Top BSC Dexs

Decentralized Derivatives and Futures Exchanges: A Specialized Niche

Within the DEX ecosystem, decentralized derivatives and futures exchanges focus on trading derivative products, financial instruments whose value is derived from underlying assets like cryptocurrencies. These include futures contracts, agreements to buy or sell an asset at a future date for a set price, and perpetual contracts, which resemble futures but lack expiration dates, allowing indefinite holding. These platforms enable leveraged trading, where users can amplify potential returns (and risks) by borrowing capital, making them attractive for speculative strategies.

The importance of these exchanges lies in their ability to offer self-custody, reducing counterparty risk compared to centralized exchanges, and their transparency, as all trades are recorded on-chain. They also democratize access to derivatives markets, previously dominated by centralized platforms, fostering financial inclusion in the DeFi space.

Top 5 Decentralized Derivatives and Futures Exchanges

1. ox.fun

https://ox.fun/register?shareAccountId=portal

Overview: Launched in 2024, ox.fun positions itself as a NextGen perps trading platform, branding itself as “The House of Memes.” It targets memecoin traders, allowing futures trading without selling assets, with a focus on high leverage and unique collateral options.

Products Offered: Offers perpetual futures with up to 100x leverage on major and meme coins, supporting strategies like staking in automated vaults for daily rewards. It claims to support 200+ tokens, including first-to-market futures on latest memecoins.

Key Features: Users can deposit any token to trade any other, such as depositing $PEPE to long $MOG, enhancing flexibility. It offers a mobile app for Android and iOS, and a simple sign-up process, taking 10 seconds. Strategies are detailed at https://ox.fun/strategies.

Liquidity and Fees: Reports a 24-hour trading volume of approximately $65 million and open interest of $33.5 million, with 532 trading pairs. It claims 0% trading fees, though this needs verification, as fee structures tied to $OX token suggest potential nuances.

Security: As a new platform, specific security audits are not widely documented, posing a potential risk for users.

Blockchain Compatibility: Operates on Solana, benefiting from its high-speed, low-cost transactions, ideal for memecoin trading.

User Experience: Designed for ease of use, especially for retail traders, with a gamified approach and social features like the Degen Feed for alpha.

Start Ox.Fun https://ox.fun/register?shareAccountId=portal

2. dydx

Overview: dydx, a pioneer in decentralized perpetual futures, offers a professional trading experience rebuilt on dYdX Chain, a Cosmos-based Layer 1. It’s known for its high liquidity and advanced features, catering to both retail and institutional traders.

Products Offered: Focuses on perpetual contracts with up to 100x leverage, trading top crypto pairs with frequent new listings. It supports advanced order types, including price triggers.

Key Features: Emphasizes self-custody, ensuring users control their funds. Offers rewards in $DYDX for trading, fast onboarding with existing crypto wallets, and governance by traders. It’s fully decentralized, with an open-source protocol documented at https://docs.dydx.exchange and code on Github at https://github.com/dydxprotocol/v4-chain.

Liquidity and Fees: High liquidity, being a top DEX, with a tiered fee structure: maker fees range from -0.05% to 0.05% and taker fees from 0.05% to 0.10%, depending on 30-day trading volume. Funding rates apply to perpetuals.

Security: Established with robust smart contracts, built on Ethereum initially, and now on dYdX Chain, with a strong track record.

Blockchain Compatibility: dYdX Chain, offering enhanced performance and scalability.

User Experience: Provides a responsive web interface and native applications, ideal for professional traders, with a help center at https://help.dydx.exchange for learning.

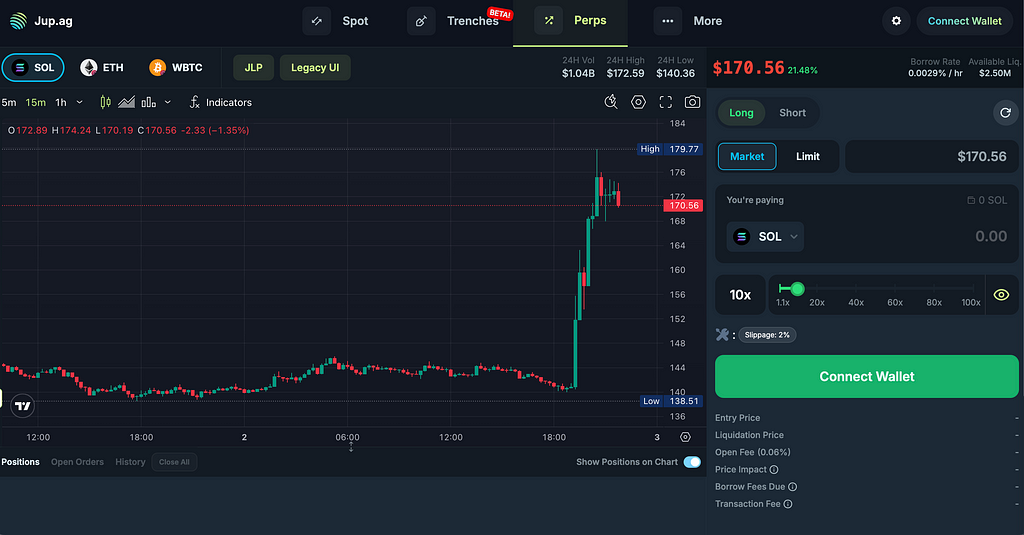

3. Jupiter (Jup)

Overview: Jupiter, the #1 decentralized exchange on Solana, extends beyond spot trading to offer perpetuals, leveraging its position as a DEX aggregator. It’s known for low fees and optimal swap rates, appealing to Solana users.

Products Offered: Offers perpetuals for SOL, ETH, and wBTC with up to 100x leverage, integrated with its swap functionality. It also supports limit orders, dollar-cost averaging, and bridge comparator features.

Key Features: Uses a liquidity pool (JLP) for perpetuals, allowing traders to open long or short positions with any Solana token as collateral. Prices are oracle-based, reducing price impact. Detailed guides are available at https://station.jup.ag/guides/perpetual-exchange/overview.

Liquidity and Fees: High liquidity, with significant derivatives volume reported at over $3.1 billion recently, per DeFi Llama. Swap fees are low, but specific perpetual trading fees are not detailed, suggesting standard industry rates.

Security: Inherits Solana’s security, with additional measures for perpetuals, though specifics are less documented.

Blockchain Compatibility: Solana, benefiting from fast transactions and low costs, ideal for high-frequency trading.

User Experience: User-friendly interface, mobile app available, and integration with Phantom Wallet for seamless trading, detailed at https://apps.apple.com/us/app/jupiter-solana-defi-wallet/id6484069059.

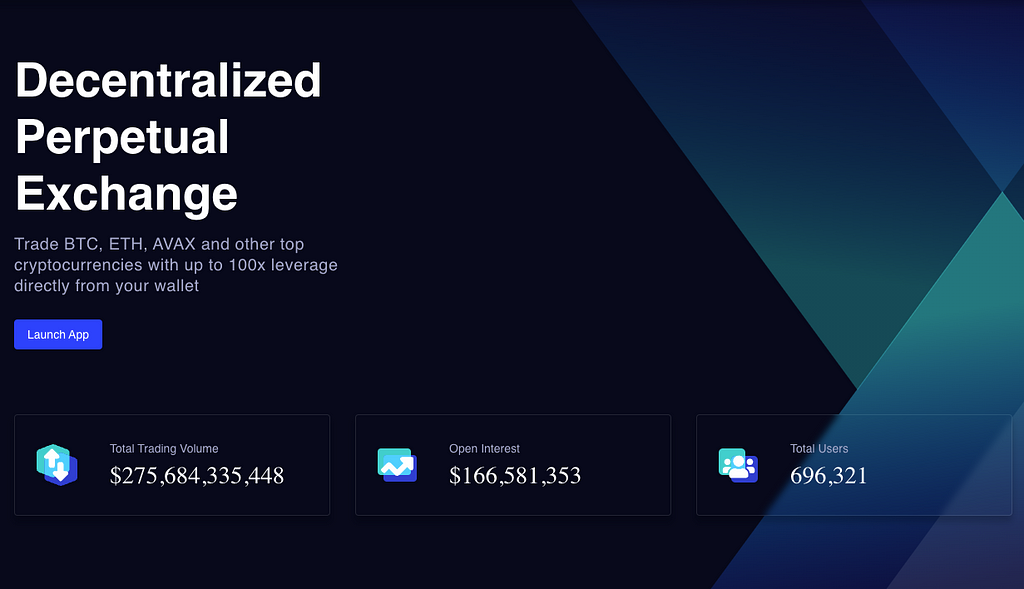

4. GMX:

Overview: GMX, launched in September 2021 as Gambit Exchange, is a decentralized spot and perpetual exchange on Arbitrum and Avalanche, known for low swap fees and minimal price impact. It’s a leader in derivatives DEX space with over $130 billion total trading volume.

Products Offered: Offers spot trading and perpetual futures with up to 100x leverage on popular cryptocurrencies like BTC, ETH, AVAX, etc. It uses a multi-asset pool for liquidity.

Key Features: Features a native multi-asset pool, GLP, generating revenue for liquidity providers without impermanent loss. Dynamic pricing is supported by Chainlink Oracles, with documentation at https://gmx.io/docs/. Governance and staking with GMX token enhance user participation.

Liquidity and Fees: High, leading on Arbitrum and Avalanche, with a total value locked (TVL) over $480 million as of recent reports. Fees include 0.02% for swaps and variable fees for perpetuals based on position size and market conditions.

Security: Built on layer-2 solutions, with a focus on security, and backed by a strong DeFi community.

Blockchain Compatibility: Arbitrum and Avalanche, offering scalability and low transaction costs.

User Experience: Comprehensive user interface, supporting both spot and perpetual trading, with wallet connectivity for easy access.

5. SynFutures

https://oyster.synfutures.com/

Overview: SynFutures, a next-generation synthetic assets derivatives exchange, focuses on creating an open, trustless market. It’s among the top three most actively used decentralized derivative exchanges, with significant growth on Polygon.

Products Offered: Allows trading futures and perpetuals with up to 100x leverage, supporting any asset with a price feed, including meme coins and Liquid Restaking Tokens (LRTs). Offers permissionless listings, enabling users to list and trade asset pairs within seconds.

Key Features: Utilizes Oyster AMM, blending automated market-making with order book efficiency, and introduces single-token concentrated liquidity for derivatives. Detailed at https://docs.synfutures.com/. Backed by Tier 1 investors like Pantera Capital, with a team experienced in finance and blockchain.

Liquidity and Fees: High, especially on Polygon, with over $800 million monthly average trading volume reported. Charges a 0.05% trading fee on all trades, enhancing capital efficiency.

Security: Has undergone security audits, with a strong team from global financial institutions, ensuring robust risk management.

Blockchain Compatibility: Deployed on multiple blockchains, including Polygon, Ethereum, Arbitrum, and BNB Chain, for broad accessibility.

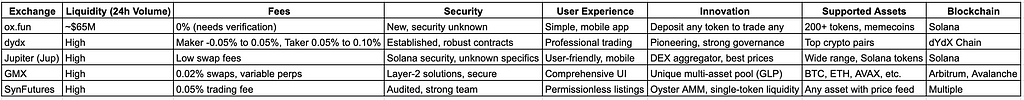

Comparative Analysis

The comparison table above summarizes key metrics, but here’s a deeper dive:

Liquidity: All five exchanges show high liquidity, with dydx, GMX, and SynFutures leading due to established presence, while ox.fun and Jupiter benefit from Solana’s ecosystem.

Fees: Fees vary, with dydx offering competitive tiered fees, GMX at 0.02% for swaps, and SynFutures at 0.05%, while ox.fun’s 0% claim needs verification, and Jupiter’s are low but not detailed for perps.

Security: dydx and GMX have strong track records, SynFutures is audited, while ox.fun’s newness and Jupiter’s specifics are less clear, suggesting caution.

User Experience: All offer user-friendly interfaces, with dydx and GMX for professionals, Jupiter and ox.fun for retail, and SynFutures for broad accessibility.

Innovation: ox.fun’s memecoin focus, GMX’s GLP pool, Jupiter’s aggregator model, and SynFutures’ Oyster AMM stand out, each addressing different market needs.

Supported Assets: Wide ranges across all, with ox.fun and SynFutures offering unique flexibility, while dydx, GMX, and Jupiter focus on top cryptos.

Conclusion and Recommendations

Research suggests these five exchanges are among the best for decentralized derivatives and futures trading, each catering to different user needs. For memecoin traders, ox.fun is likely ideal; for professional trading, dydx and GMX stand out; for Solana users, Jupiter offers convenience; and for broad asset access, SynFutures is recommended. Users should consider their trading strategy, risk tolerance, and preferred blockchain when choosing, given the complexity and evolving nature of DeFi.

Learn More

- BULLX ACCES CODE

- Best Solana Copy Trade Bots

- Best Soalan Sniper Bots

- Best ETH Bots

- Best SOLANA Dexs

- Best Solana Trading Bots

- Best Solana Wallets

- Best BSC Wallets

- Best Ton Wallets

- Nova access Code

- Best DEXS for Futures Trading

- Best BSC Trading Bots

- Top BSC Dexs

- Best Base Network Trading Bots

- Bullx Exchange

- BULLX CODE

- Bullx Neo

Top 5 Best Decentralized Exchanges: Futures & Perpetuals was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.