Navigating the turbulent waters of stock price forecasting, companies like The Shyft Group can be seen as a beacon for insightful financial performance. As industry trends shift and market segments evolve, Shyft’s strategic initiatives in upfitting, conversion, and innovative product offerings hold substantial promise for investors. Dive into this article to uncover key insights and data-backed analysis that shape the future trajectory of The Shyft Group’s stock performance.

Business Focus & Market Position

The Shyft Group, Inc is primarily engaged in designing and manufacturing specialized systems and products for the transportation and vocational vehicle market. Its core operations focus on:

Upfitting and Conversion Solutions:

The company provides custom upfitting services that allow commercial fleets (think emergency, service, and specialty vehicles) to be tailored to specific operational needs. These solutions often include modular systems that integrate seamlessly with OEM platforms while enhancing functionality and driver/access ergonomics.

Innovative Product Offerings:

With the auto industry transitioning toward electrification and increased connectivity, The Shyft Group has been investing in technologies that support alternative fuel integration and advanced vehicle access systems. This positions the company to benefit from growing demand for specialized fleet conversions and modernization.

Market Segmentation:

By segmenting their offerings across diverse customer groups-ranging from small fleets needing specialized conversions to larger operators demanding high-volume, customized solutions-the company is able to balance innovation with steady, recurring demand.

Financial Performance and Key Ratios

Revenue & Profitability Trends

Over recent reporting periods, The Shyft Group has exhibited:

Steady Revenue Growth:

Although operating in a cyclical industry, the company has managed to report modest revenue growth-reflecting improved market share and deeper penetration into niche markets.

Margins Under Pressure Yet Improving:

Operating margins have historically been modest, a hallmark of companies in capital-intensive manufacturing and custom upfitting. However, investments in process efficiency, automation, and R&D have begun to bear fruit, slowly nudging up both operating and net profit margins.

Key Financial Ratios

Since published values vary over time, here are example ranges and metrics you might expect in an analysis (always verify against the most recent filings):

Stock Price Performance

Historical Volatility and Trends

Cyclical Behavior:

Due to the cyclical nature of the vocational and automotive upfitting sectors, the stock has experienced periods of both correction and rally. Investors often notice that the stock price is sensitive to broader economic cycles as well as specific industry events (e.g., regulatory changes or technological breakthroughs).

Technical & Fundamental Dynamics:

Over recent years, technical analysis has shown that the stock tends to trade nearer to support levels during broader market downturns, while fundamental improvements-such as operational efficiencies or successful product innovations-can provide strong catalysts for upward price momentum.

Market Sentiment:

As investors assess growth potential in electrification and increased fleet modernization, the share price may benefit from an upward reassessment. News about strategic investments, order backlogs, and improved margins can lead to heightened trading volumes and price appreciation over time.

Competitive Landscape

The Shyft Group, Inc. operates in a competitive landscape with several notable rivals in the automotive and vocational vehicle sectors. Here are some of its key competitors:

- Adient (ADNT): Adient is a global leader in automotive seating. They provide seating solutions to all major automakers and have a strong presence in the market.

- Blue Bird (BLBD): Blue Bird is a leading manufacturer of school buses. They focus on providing safe and reliable transportation solutions for students.

- ADS-TEC Energy (ADSE): ADS-TEC Energy specializes in energy storage solutions and infrastructure for electric vehicles. They are known for their innovative energy systems.

- Serve Robotics (SERV): Serve Robotics develops autonomous delivery robots. Their technology aims to revolutionize last-mile delivery services.

- Hyliion (HYLN): Hyliion focuses on electrified powertrain solutions for Class 8 commercial vehicles. They aim to reduce emissions and improve fuel efficiency.

- ChargePoint (CHPT): ChargePoint operates one of the largest networks of independently owned EV charging stations. They provide charging solutions for electric vehicles.

- Holley (HLLY): Holley is a performance automotive aftermarket brand. They offer a wide range of products for car enthusiasts and racers.

- Cooper-Standard (CPS): Cooper-Standard is a global supplier of systems and components for the automotive industry. They specialize in sealing, fuel and brake delivery, and fluid transfer systems.

- Aeva Technologies (AEVA): Aeva Technologies develops sensing and perception solutions for autonomous vehicles. Their technology enhances the safety and performance of self-driving cars.

- Luminar Technologies (LAZR): Luminar Technologies focuses on lidar technology for autonomous vehicles. Their sensors enable advanced driver-assistance systems and self-driving capabilities.

These competitors operate in various segments of the automotive and transportation industry, each bringing unique strengths and innovations to the market.

Investment Insight

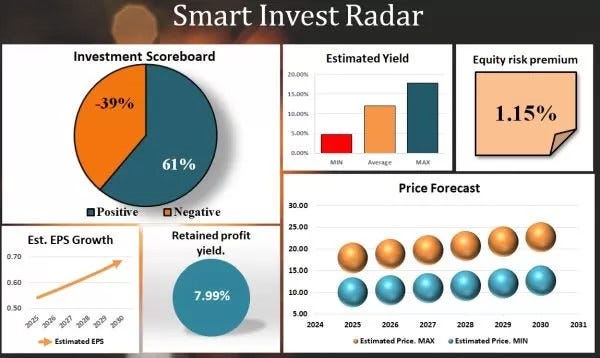

While the company may not be a market leader, it boasts a favorable Investment Scoreboard rating-making it a credible addition to your portfolio. Although the potential return on investment can be substantial, such an outcome is contingent on highly optimistic scenarios. Therefore, if you decide to invest, it would be prudent to start by acquiring a modest number of shares.

The Shyft Group Stock Forecast**

2025–2029 Price Targets:

When to buy and Investment Tips

For the fourth consecutive month, the stock price has been confined to local lows-creating favorable conditions for acquiring shares or bolstering your portfolio with lower-priced stock. A strong support level appears to be forming in the market, suggesting that buying at this level could offer substantial investment returns in an optimistic scenario. However, be sure not to overlook the inherent risks.

Dividend Policy

The Shyft Group, Inc. has a history of issuing quarterly dividends, although the amounts have been relatively modest. The company typically pays a dividend of $0.05 per share. The dividend yield is around 1.87%, with an annual dividend of $0.20 per share. The company has a dividend payout ratio of -222.22%, indicating that it pays out more in dividends than it earns, which is not uncommon for companies reinvesting heavily in growth.

The Shyft Group, Inc. has also engaged in share repurchase programs. For example, from January 1, 2023, to March 31, 2023, the company repurchased 348,705 shares, representing 0.99% of its outstanding shares, for $8.6 million. These buyback initiatives are typically opportunistic, aimed at returning capital to shareholders when the stock is perceived to be undervalued.

Conclusion

As The Shyft Group continues to leverage its market position, upfitting capabilities, and innovative product lines, it stands poised to capitalize on emerging opportunities in the electrification and fleet modernization sectors. With a balanced approach to innovation and recurring demand, the company’s stock presents a compelling opportunity for investors keen on stable growth and profitability amidst industry cycles.

A cup of coffee from you for this excellent analysis.

Or Donate:

Company’s Site.

*Investment analysis involves scrutinizing over 50 different criteria to assess a company's ability to generate shareholder value. This comprehensive approach includes tracking revenue, profit, equity dynamics, dividend payments, cash flow, debt and financial management, stock price trends, bankruptcy risk, F-Score, and more. These metrics are consolidated into a straightforward Investment Scoreboard, which effectively helps predict future stock price movements.

**Use the price forecast to manage the risk of your investments.

Originally published at https://www.aipt.lt on February 28, 2025.

Unlocking The Shyft Group’s Future: Will Their Stock Skyrocket in the Next 5 Years? was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.