In the dynamic world of bioprocessing and life sciences, Repligen Corporation stands out as a prominent player. With its innovative bioprocessing technologies, the company has shown remarkable growth and resilience. But what does the future hold for Repligen’s stock price? Let’s dive into the projections and uncover the potential opportunities and challenges ahead.

Operations

Repligen Corporation (NASDAQ: RGEN) is a global life sciences company headquartered in Waltham, Massachusetts. It specializes in developing and commercializing bioprocessing technologies and systems used in the manufacturing of biological drugs, such as monoclonal antibodies, recombinant proteins, vaccines, and cell and gene therapies. The company serves a broad customer base, including biopharmaceutical companies, contract development and manufacturing organizations (CDMOs), and other life sciences entities.

Repligen’s operations are organized into four main product franchises:

- Filtration (including Fluid Management): The largest segment, accounting for a significant portion of revenue (approximately 54% in 2023). This includes products like XCell ATF systems used in upstream perfusion and N-1 cell culture processing.

- Chromatography: Representing about 20% of revenue, this franchise offers products for downstream purification and quality control of biological drugs.

- Proteins: Contributing around 16% of revenue, this includes protein products that support bioprocessing workflows.

- Process Analytics: The smallest segment at about 9% of revenue, offering analytics tools that complement the other franchises.

Geographically, Repligen generates revenue from North America (44%), Europe (37%), and Asia Pacific (19%). The company has expanded its portfolio through strategic acquisitions, such as the 2017 purchase of Spectrum Inc. for $359 million, enhancing its filtration capabilities.

Financial Performance and Ratios

Repligen has historically demonstrated strong financial performance as a growth-oriented company in the bioprocessing sector.

Revenue Growth: Repligen has consistently grown its revenue, driven by demand for bioprocessing solutions in biologics manufacturing. For example, revenue increased from $270.2 million in 2018 to over $600 million by 2023, reflecting a compound annual growth rate (CAGR) exceeding 20% in prior years.

Profitability: The company maintains healthy gross margins, often above 50%, due to its focus on high-value, specialized products. Operating margins have typically ranged between 20–30%, reflecting efficient cost management alongside R&D investment.

Financial ratios and metrics:

- Enterprise Value: $8.33 billion

- P/E Ratio: Not applicable (negative earnings)

- Forward P/E Ratio: 88.15

- Price-to-Sales Ratio: 13.29

- Price-to-Book Ratio: 4.19

- Return on Equity (ROE): -0.40%

- Return on Invested Capital (ROIC): 0.63%

- Revenue: $633.51 million

- Net Income: -$8.10 million

Repligen Corporation Stock Price Performance

Long-Term Trend: From 2015 to 2021, RGEN experienced a remarkable run-up, with its stock price rising from around $30 to a peak of over $300 by late 2021, driven by robust revenue growth and investor enthusiasm for biotech.

Recent Performance: After peaking in 2021, the stock faced pressure in 2022–2023 amid broader market corrections and higher interest rates, which impacted growth stocks. By early 2025, the stock price has fluctuated, with reports indicating it traded around $159-$191 in late February 2025 (based on analyst target updates). On March 07, 2025, the exact price would depend on real-time market data, but it has likely remained in a range reflective of its 2024–2025 trajectory.

Volatility: RGEN is subject to biotech sector sentiment, acquisition announcements, and earnings results. For instance, it gapped down to $159.045 on February 21, 2025, but was trading 3.62% higher by February 25, indicating short-term swings. As of the latest data, the stock price is $160.11, with a 52-week high of $203.13 and a 52-week low of $113.50. The stock has decreased by -27.68% in the last 52 weeks

Competitive Landscape

Revenue Growth:

Repligen has shown a revenue increase of 9.69% year-on-year in Q3 2024, while most of its competitors experienced a contraction in revenues by -4.89%. This indicates that Repligen is outperforming its competitors in terms of revenue growth.

Net Income:

Despite the revenue growth, Repligen recorded a net loss, while most of its competitors saw an income increase of 7.57%. This suggests that while Repligen is growing its top line, it is facing challenges in converting that growth into profitability.

Stock Performance:

Repligen’s stock performance has been mixed compared to its competitors. For example, Thermo Fisher Scientific saw a slight decline of -1.23% over the past five days, while Danaher Corporation experienced a more significant decline of -13.75% this quarter. Repligen’s stock price has decreased by -27.68% in the last 52 weeks, indicating a challenging year for the company.

Market Share:

Repligen has improved its market share within the overall company to approximately 0.8%. This is a positive sign, showing that Repligen is gaining ground in the market despite the competitive landscape.

Competitors:

Repligen’s main competitors include Danaher Corporation, Thermo Fisher Scientific, and Sartorius. These companies are also leaders in the bioprocessing and life sciences industry, offering a range of products and solutions similar to Repligen.

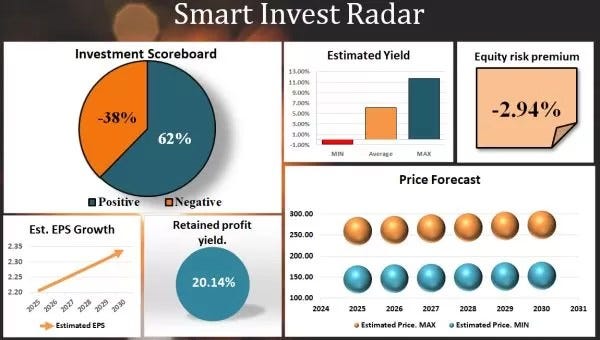

Investment Insight

Although this company does not exhibit exceptionally high profitability metrics, it stands out as a robust generator of cash flows. Repligen is a typical participant in its sector, suggesting that investors should temper their expectations regarding its future prospects. While the stock price has historically achieved a compound annual growth rate (CAGR) of up to 20%, future price appreciation is likely to be significantly slower, potentially half that rate.

Analyst Ratings: Repligen has received a consensus rating of „Moderate Buy” from 13 Wall Street analysts. Out of these, 5 analysts have given a hold rating, and 8 have given a buy rating1. Price Targets: The average price target for Repligen over the next 12 months is $181.00, with a high estimate of $205.00 and a low estimate of $155.00. This represents a forecasted upside of approximately 15.63% from the current price.

Therefore, if you decide to include Repligen Corporation’s stock in your portfolio, it is advisable to maintain a relatively small allocation. Typically, prudent investors, as outlined in Benjamin Graham’s The Intelligent Investor, avoid overloading their portfolios with companies that are not market leaders, favoring instead those with stronger competitive advantages and more predictable outperformance.

Repligen Corporation Stock Forecast**

2025–2029 Price Targets:

When to buy and Investment Tips

Despite the fact that Repligen Corporation’s stock price has declined by more than 40% from its all-time high (ATH), it appears that the market still overvalues it relative to the yield of risk-free financial instruments and the company’s projected profitability metrics. Consequently, if you’re considering a near-term purchase, it would be prudent to wait for a further correction before buying, thereby reducing downside risk. The stock exhibits greater volatility than the broader market, with a beta of 1.18, indicating it falls more sharply during downturns but also rises more rapidly during upswings.

Summary Table

Dividend Policy

Repligen does not pay a dividend, which is typical for a growth-focused company in the life sciences sector. Instead, it reinvests profits into R&D, acquisitions, and operational expansion to fuel future growth. This aligns with its strategy to prioritize long-term value creation over short-term shareholder payouts.

Dividends: Repligen has no history of paying dividends, and there is no indication of a policy shift as of March 07, 2025. The company’s capital allocation prioritizes growth over income distribution.

Share Buybacks: Repligen has not been a significant player in share repurchasing. Unlike mature companies that use buybacks to boost earnings per share (EPS) or return excess cash, Repligen directs its cash flow toward organic growth and strategic acquisitions (e.g., Spectrum Inc.). There is no widely documented or consistent buyback program in place, and any repurchasing activity would likely be opportunistic rather than a formal policy.

Conclusion

Repligen Corporation offers a compelling yet cautious investment opportunity in the bioprocessing sector. While its historical growth outpaced the S&P 500, recent volatility and a tempered outlook suggest slower gains ahead-potentially half its past 20% CAGR. With no dividends and a focus on reinvestment, it’s not a market leader but a solid cash flow generator. Waiting for a price correction could minimize risk, making it a strategic addition for patient investors seeking biotech exposure.

A cup of coffee from you for this excellent analysis.

Or Donate:

Company’s Site.

*Investment analysis involves scrutinizing over 50 different criteria to assess a company's ability to generate shareholder value. This comprehensive approach includes tracking revenue, profit, equity dynamics, dividend payments, cash flow, debt and financial management, stock price trends, bankruptcy risk, F-Score, and more. These metrics are consolidated into a straightforward Investment Scoreboard, which effectively helps predict future stock price movements.

**Use the price forecast to manage the risk of your investments.

Originally published at https://www.aipt.lt on March 7, 2025.

Repligen Corporation Stock Forecast 2025–2029: Will It Beat the S&P 500 Again or Crash? was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.