Why Coca-Cola’s Stock Could Hit $137 Next Year — Don’t Miss This Forecast!

What if you could predict the future of a stock that’s been a global icon for over a century? The Coca-Cola Company, the world’s largest beverage giant with a sprawling empire of 500 brands, isn’t just a household name-it’s a financial powerhouse. As its stock nears record highs in March 2025, investors are asking: Is now the time to buy, or should you wait for the perfect dip? Dive into our forecast to uncover Coca-Cola’s next move.

The Coca-Cola Company: A Beverage Titan

The Coca-Cola Company reigns as the world’s largest beverage firm, commanding a portfolio of ~500 non-alcoholic brands and 3,600 products-from carbonated classics like Coca-Cola and Sprite to waters, juices, energy drinks, and ready-to-drink teas.

Financial Performance and Key Ratios

In 2024, Coca-Cola’s revenue climbed 2.86% to $47.06 billion, fueled by robust demand in Latin America, Asia Pacific, and resilient developed markets like Mexico and Germany. Net income slipped 0.77% to $10.63 billion, hinting at rising costs. With $14.57 billion in cash and $46.66 billion in debt, its debt-to-equity ratio (1.77) offers flexibility, though a current ratio of 1.03 signals tight liquidity. Key metrics include a P/E of 28.81, forward P/E of 23.93, ROE of 39.55%, and a 2.88% dividend yield.

Stock Price Performance

The Coca-Cola Company’s stock has shown strong performance over the years. As of March 7, 2025, the stock price is $71.42, with a market capitalization of $307.22 billion. The stock has a 52-week high of $73.53 and a 52-week low of $57.93

The stock hit an all-time high of $71.97 in September 2024, reflecting a 16.81% increase over the past year. This performance outpaces the broader market’s volatility, buoyed by Coca-Cola’s low beta of 0.62, which signals lower price swings compared to the S&P 500. Analysts’ average price target sits at $73.65-$74.06, with a “Strong Buy” consensus from 17 analysts, suggesting modest upside potential of 3–4%.

Competitive Landscape

The beverage industry is dominated by a handful of giants, each with distinct strategies and market positions. The Coca-Cola Company (KO), PepsiCo (PEP), Keurig Dr Pepper (KDP), Nestlé (NESN), and Danone (BN) represent a spectrum of approaches-from pure-play beverages to diversified food and nutrition portfolios.

Here’s a comparison of Coca-Cola and PepsiCo’s financial performance:

Financial Performance

- Revenue: PepsiCo reported revenue of $22.32 billion in the second quarter of 2023, surpassing projections of $21.73 billion. Coca-Cola registered adjusted revenue of $11.97 billion, exceeding expectations of $11.75 billion.

- Market Capitalization: As of 2024, Coca-Cola’s market capitalization is approximately $304.81 billion, while PepsiCo’s is around $240 billion.

- PE Ratio: Coca-Cola has a PE ratio of 28.81, while PepsiCo’s is slightly lower at 25.67.

- Dividend Yield: Coca-Cola offers a dividend yield of 2.88%, whereas PepsiCo’s dividend yield is higher at 3.02%.

Growth and Resilience

- Revenue Growth: PepsiCo has shown higher revenue growth compared to Coca-Cola. PepsiCo’s revenue growth is driven by its diversified product portfolio, which includes snacks and beverages.

- Resilience: Both companies have demonstrated resilience during market downturns. However, PepsiCo’s business proved to be more resilient during the 2020 recession.

Diversification

- Product Portfolio: Coca-Cola is known for its star namesake beverage and other brands like Fanta, Sprite, and Powerade. PepsiCo, on the other hand, has a highly successful snack business, which represents roughly half of the company’s U.S. revenue.

- Geographic Revenue: PepsiCo’s revenue is concentrated in the U.S., with 57% of total revenue made in the U.S., while Coca-Cola generated only 36.60% of its revenue in North America.

Stock Performance

- Stock Price: As of March 2025, Coca-Cola’s stock price is $71.42, while PepsiCo’s stock price is $180.25.

- 52-Week High/Low: Coca-Cola’s 52-week high is $73.53 and its 52-week low is $57.93. PepsiCo’s 52-week high is $182.50 and its 52-week low is $155.00.

Overall, both Coca-Cola and PepsiCo are strong performers in the beverage industry, but PepsiCo’s diversified product portfolio and higher revenue growth give it a slight edge in terms of financial performance and resilience.

Investment Insight

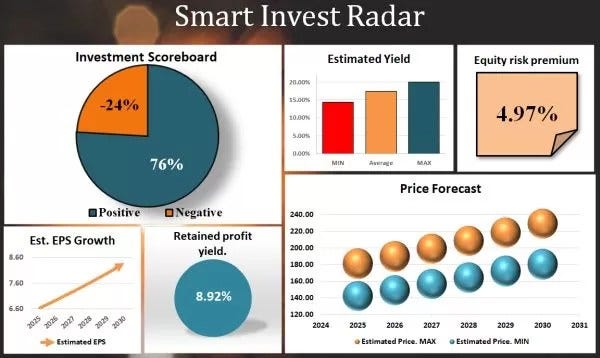

No one doubts that we are dealing with an exceptionally large and highly profitable company. Even in the face of fierce competition, The Coca-Cola Company manages to sustain an impressive Gross profit margin of nearly 60% and a Net profit margin exceeding 23%. These figures clearly demonstrate the company’s extraordinarily strong market position.

Coca-Cola’s financial health is indisputable, bolstered by a wide economic moat derived from its powerful brand and global distribution network. Its ability to grow revenue in a mature industry, maintain a high return on equity (ROE), and generously reward shareholders is worthy of praise.

As evidenced by its outstanding operational results, the calculated price outlook suggests that even in a pessimistic scenario, investors stand to earn a solid return if they buy now (as of this writing on March 10, 2025). This further confirms that Coca-Cola not only remains a market leader but also presents an attractive opportunity for investors seeking both stability and growth potential.

Stock Forecast**

2025–2029 Price Targets:

When to buy and Investment Tips

From a technical analysis perspective, Coca-Cola’s stock price is currently hovering near its all-time high (ATH). This proximity to the peak suggests that now may not be the optimal moment to enter a new position or add to an existing portfolio. In such scenarios, the prudent approach is typically to await a price correction, which could enhance potential investment returns by offering a more favorable entry point.

However, should the stock break above its ATH resistance level and continue its upward trajectory, investors may need to buy at a higher price. Even in that case, the move could still yield a positive return, albeit with a narrower margin of safety. Timing remains critical, and patience could prove rewarding in maximizing long-term gains.

Dividend Policy and Buyback Policy

Coca-Cola’s shareholder-friendly capital allocation strategy is a cornerstone of its appeal. The company paid $8.0 billion in dividends in 2023, with an annual dividend of $2.04 per share as of early 2025, equating to a yield of around 2.85%-2.97% (depending on the stock price). This marks its 63rd consecutive year of dividend increases, with a 5.2% hike approved in 2024, reinforcing its status as a Dividend King.

In addition to dividends, Coca-Cola has a share buyback program. The company announced a share buyback program of up to €1 billion, which began on February 18, 2025, and is expected to be completed by the end of February 2026. The purpose of the program is to reduce the issued share capital of the company.

Conclusion

Coca-Cola stands tall as a beverage behemoth, blending financial resilience with shareholder rewards. Its stock, flirting with all-time highs in March 2025, offers stability and modest upside-perfect for cautious optimists. While near-term timing demands patience, long-term forecasts (up to $166.08 by 2029) signal enduring growth. Whether you’re chasing dividends or capital gains, Coca-Cola remains a fizzy prospect in a volatile market.

A cup of coffee from you for this excellent analysis.

Or Donate:

Company’s Site.

*Investment analysis involves scrutinizing over 50 different criteria to assess a company's ability to generate shareholder value. This comprehensive approach includes tracking revenue, profit, equity dynamics, dividend payments, cash flow, debt and financial management, stock price trends, bankruptcy risk, F-Score, and more. These metrics are consolidated into a straightforward Investment Scoreboard, which effectively helps predict future stock price movements.

**Use the price forecast to manage the risk of your investments.

Originally published at https://www.aipt.lt on March 10, 2025.

Why Coca-Cola’s Stock Could Hit $137 Next Year — Don’t Miss This Forecast! was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.