📜 Trump signs executive order on tariffs

🇺🇸 A blanket 10% tariff on all U.S. imports kicks in from 5 April (Canada & Mexico excluded via USMCA).

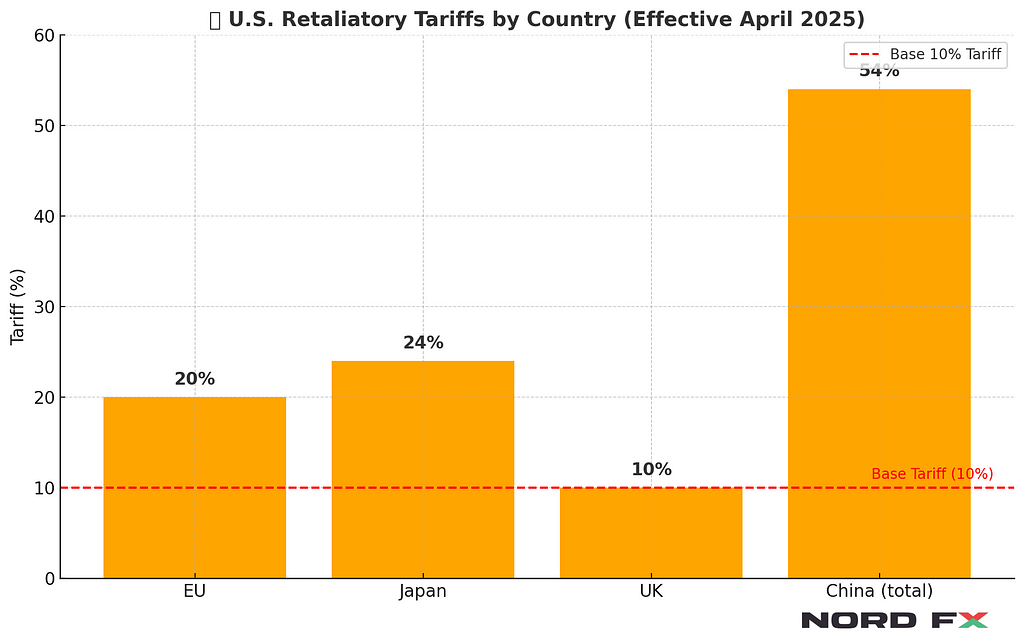

🚫 Retaliatory tariffs effective 9 April:

🇪🇺 EU: 20%

🇯🇵 Japan: 24%

🇬🇧 UK: 10%

🇨🇳 China: extra 34% → Total: 54%

🚗 Auto tariffs? Already in effect from today.

📉 Wall Street: Green closes, red futures

🟢 Yesterday:

S&P 500: +0.87%

DJIA: +0.56%

Nasdaq: +0.87%

Russell 2000: +1.65%

🔴 After-hours plunge post “Liberation Day” speech:

S&P 500: -2.7%

DJIA: -2%

Nasdaq: -3.2%

Russell 2000: -4%

⚠️ Magnificent 7 meltdown

📉 Tesla -8% | Apple -7% | Amazon -6%

📉 Nvidia -5.7% | Meta -4.7% | Alphabet -3.5% | Microsoft -2.9%

🇪🇺 Von der Leyen responds:

Slams U.S. tariffs, calls for “🕊️negotiation not confrontation.”

🔨 EU preparing countermeasures on steel & aluminium.

💬 Fed’s Kugler: No rush to cut rates amid inflation worries.

📊 UBS warns: Tariffs could push 🇺🇸 inflation to 5%.

🌏 Asia-Pacific deep in red

🇯🇵 Nikkei 225: -3.3%

🇭🇰 HSCEI: -1.7%

🇨🇳 Shanghai: -0.5%

🇰🇷 Kospi: -1.15%

🇦🇺 ASX 200: -0.95%

📈 China Services PMI surprises:

🧾 51.9 (forecast 51.5) → Best new business growth since Dec, plus lower costs & hiring surge.

📈 Australia Services PMI rises:

From 51.3 → 51.6

Growth driven by lower price pressures & highest employment jump since April 2023.

💱 FX Market:

💥 After Trump’s speech, the dollar weakens across the board (USDIDX: -0.75%).

📉 USDJPY: -1.4%

📈 CHFUSD: +1.1%

💶 EURUSD: +0.85% → Above 1.09

🏃♂️Capital flows to safe havens.

💰 Commodities bleeding:

🥇 Gold: -0.19% ($3,129/oz)

🥈 Silver: -2.13% ($33.15/oz)

🛢️ Brent & WTI: -2.5%

🔥 NATGAS: -1.7%

🪙 Crypto in retreat:

₿ bitcoin: -2.6% ($83,440)

Ξ ethereum: -2.6% ($1,831.50)

📉 Trump token: -7.5%

📉 Solana: -4.5%

📉 Chainlink: -2.9%

🌅 Morning Update | 03.04.2025 was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.